Cracking the Code: Idaho's Budget Secrets Revealed

Editorial by Senator Scott Herndon, District 1

Cracking the Code: Idaho’s Budget Secrets Revealed

Editorial by Senator Scott Herndon, District 1

Idaho’s Spending Problem

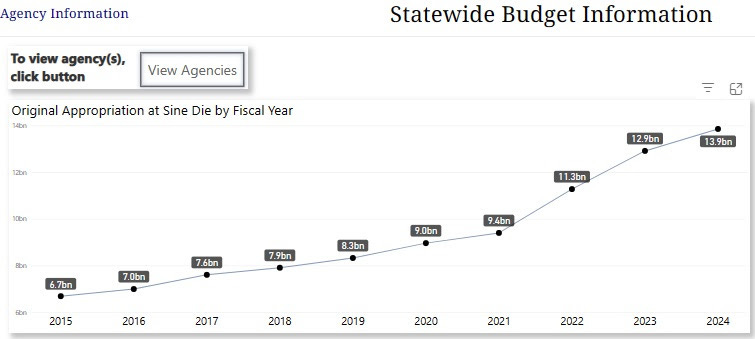

Looking at the chart below, you can see how Idaho's state spending has grown 54% over just the last four years.

Three Types of Budget Accounts

Spending comes from three different types of accounts - the general fund, dedicated funds, and federal funds. The general fund money is most of the sales taxes and personal and corporate income taxes that you pay in Idaho.

A Shocking Revelation

Here is a stunning statistic. In previous years, the Idaho legislature reviewed only 19% of the total spending. Your legislature has routinely approved $10 billion budgets while not even reviewing 81% of those expenditures. That spending would continue to roll over year after year and never get a review by the legislature.

Many people now admit that the process of legislative review for the approval of budgets each year has been profoundly shallow and amounts to little more than rubber stamping. That is less a criticism of the people involved than it is a criticism of the process.

A New Approach

This year, we are changing how we do things. We have separated every budget into two pieces. The first is the base budget, and the second is the agency's request for new spending. Between legislative sessions in the summer and fall, JFAC, the budget committee, will start digging deep into the base budgets. In the meantime, breaking out the base from the new requests will allow us to spend more time on the new requests.

Children's Programs: An Example

Let's look at an example of how the new budget process will work. We fund public schools in 6 different budgets. One of the budgets is called Children's Programs and pays for things like direct educational materials for children. This budget does not pay for teachers and administrators. This year's budget request for Children's Programs is the base budget of $386.9 million plus new programs and leftover COVID money that add an additional $186.4 million.

Last year, we would have just had the opportunity to vote on one bill for $573.4 million. This year, we just voted in favor of the base budget of $386.9 million, and in the coming weeks, we will consider the additional budget request separately for the new and extra money. The new money includes $40 million for something they call "Outcomes-Based Funding." That is a program that does not exist, and they are hoping we create it this session.

Additional Requests and COVID Funding

They also want to indebt future generations of Americans with $189 million of federal funding from the COVID-era American Rescue Plan Act (ARPA). Most people don't realize that when the United States Congress spends us into debt, a lot of that money could be stopped by the state legislatures. For example, the Idaho legislature could reject the authorization of this $189 million budget request. Here are the two line items in the public school’s Children's Programs budget request:

Having already approved the base budget for Children's Programs, will the legislature now take advantage of this new line item budget process to rein in American debt and slow the growth of government?

The Idaho Freedom Caucus is committed to stopping the massive growth of Idaho’s budget.

Towards Transparency and Accountability

At least this year, the budget process at the Idaho legislature will be more transparent as to what we are voting on. When we approve a base budget, we generally support each government agency at its current service level. But now we can vote differently on the requests to expand the agencies.

Weekly Budget Setting

Another improvement in this session is that JFAC is setting budgets weekly and moving those budgets to the floors. This allows our fellow legislators to get budget bills throughout the 3-month legislative session so that they have more time to review each one. In previous years, the 120 budget bills were sent to the House and Senate floors in a rush at the end of the session, overwhelming the legislators on the floors of the House and Senate.

Governor's 2.2% Claim

This year, the governor claims his budget plan will grow government spending by just 2.2%. Unfortunately, he is not telling the whole story since he is conveniently leaving out the dedicated and federal funds from his analysis.

Unrevealed Transfers

For example, some of your $3 billion of state sales taxes that went into the general fund last year are not going into the general fund this year. Instead, they get transferred to a dedicated fund before they arrive in the general fund. Then, the governor does not count those taxes as general fund revenues. When dedicated funds get spent, those are not counted as general fund expenses.

Actual Spending Growth

Over the years, more and more money that used to go to the general fund has now been automatically transferred to dedicated funds (shown below as "State Spending"). This table shows that in 2008, 86% of sales taxes went to the general fund. In the governor's new budget plan for 2025, only 55% of sales taxes go to the general fund. This makes year-over-year comparisons of the general fund spending useless. These transfers effectively hide how much your state government is growing.

But there is a way to calculate the actual growth of government spending. JFAC will start to require that the money that is getting diverted, called transfers, gets added back to calculate year-over-year growth.

For example, the governor's budget plan shows that last year, Idaho spent $5,183,446,600 from the general fund, and he wants to spend $5,297,416,300 this year. The difference is the 2.2% he is boasting about.

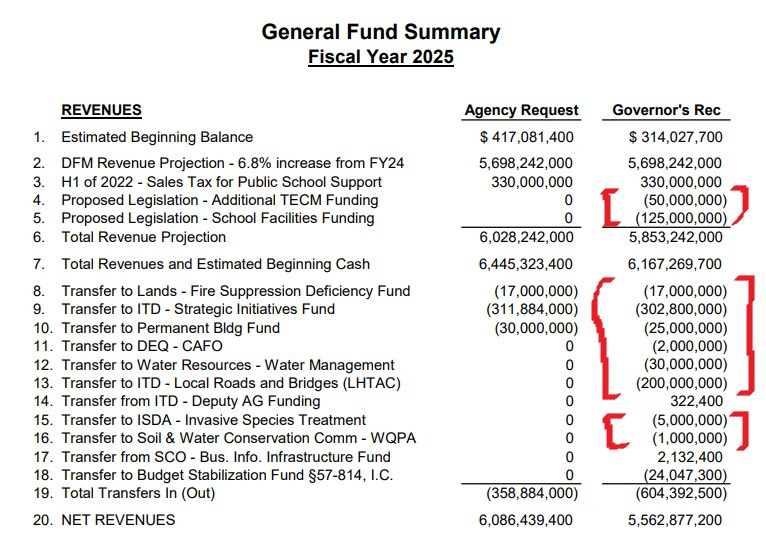

Below, I show the transfers not currently included in the governor's numbers. They are marked up in red. These should get added as expenses for this year:

If we add back the transfers to last year and the transfers to this year and then compare year-over-year general fund spending, the governor's plan calls for spending to grow by 14-17%. That is much more than the 2.2% that he is claiming. Is that how much you are growing your family's budget this year?

A Promise of Visibility

Well, the good news remains that with the changes made in JFAC’s budgeting procedures this year, much of this will be more visible than in previous years. The budgeting process will be more transparent and proceed throughout the session in manageable, bite-sized chunks. We will probably set spending levels more conservatively.

In the old way of doing business, I discovered that the Idaho Senate has not killed a budget bill on the Senate floor since 2019. That was five years ago. I think we will get better budget bills out of JFAC this year. I also think that all senators will be better able to identify problems in the spending bills on the floor and be more informed to send them back to JFAC for more work if needed.

Hope for Idaho's Budgeting Future

It’s encouraging to see Idaho's budget process undergo this transformation, which will bring about increased transparency and accountability. Through these changes, Idaho is poised for a more informed and accountable approach to budgeting, paving the way for a fiscally responsible future.

Stay tuned as we continue to report on this new budget process!

______________________________

Here are some ways you can help the Idaho Freedom Caucus:

Get to know these public members and support their work. Back Row, left to right: Sen. Glenneda Zuiderveld–District 24; Rep. Tony Wisniewski–District 5; Rep. Joe Alfieri–District 4; Rep. Mike Kingsley–District 7; Rep. Dale Hawkins–District 2; Sen. Scott Herndon–District 1. Front Row, left to right: Rep. Jacyn Gallagher-District 9; Rep. Heather Scott (Co-Chair)–District 2; Rep. Elaine Price–District 4; Sen. Tammy Nichols (Co-Chair)–District 10; Sen. Brian Lenney–District 13; Sen. Cindy Carlson–District 7.

Share this Substack to help others stay informed on what’s happening.

Follow us on Twitter and Facebook.

Donate to our Idaho Freedom Caucus PAC.

Thanks for joining us in the fight to keep Idaho free. Idaho is worth defending!

Thank you and keep up the great work you are doing!

Thank you and you counterparts for all the work you are doing on behalf of Idahoans.

This is a little off topic, but is vital to Idahoans. Would you kindly follow this link to find out what can be done, thankfully at the state level, to protect Idahoans' private property ownership rights in case of a financial collapse? It is a simple solution, but not many mipow about this. If left unchanged, the financial corporations size all bank clients' assets.

Here is the link:

https://img1.wsimg.com/blobby/go/1ee786fb-3c78-4903-9701-d614892d09d6/UCC-Article-8-State-Legislative-Alert_Final_1.pdf

It is from this website: https://thegreattaking.com/action

Thank you!

Bianca